Book Announcement: Picking Losers (Also I Was in Politico Last Week)

Hello Readers,

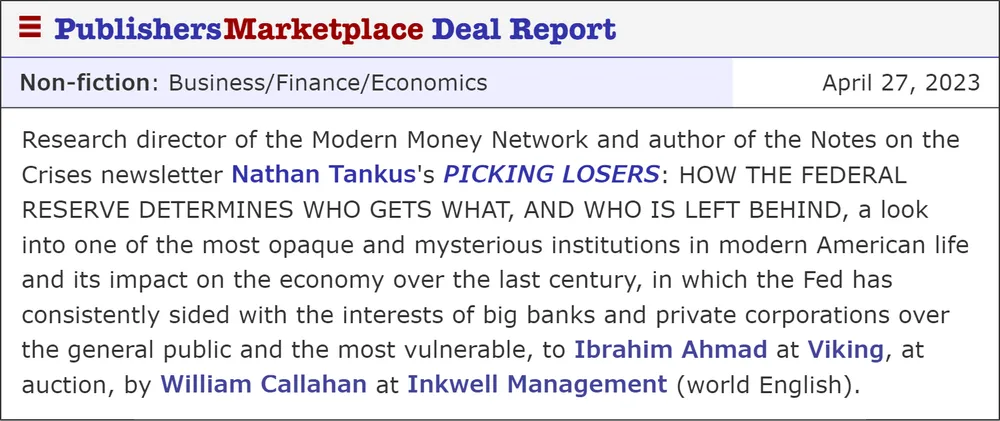

I'm very excited to announce that I'm under contract with Viking Press of Penguin for my book on the Federal Reserve entitled "Picking Losers". I'm sure I will write about some of the themes of the book (especially the more technical aspects which are too technical for a popular press book) in Notes on the Crises over the next eighteen months or so of writing, research and work I will be doing to write the book. The book sale itself is the culmination of years of work from the very beginning of the newsletter as I traced many of the themes I've written about here all the way back to World War Two. As always, thanks to the generous readers who have made this possible.

In other exciting news, I had an Op Ed last week in Politico on the debt ceiling entitled "Biden Can Steamroll Republicans on the Debt Ceiling- And Fed Chair Jay Powell won’t interfere". It was extremely exciting to tell the story of "Defaulted Treasury Securities" and the Federal Reserve's reluctant willingness to buy them. Here's how the Op Ed opens:

The threat of a real debt ceiling crisis is growing rapidly. House Republicans are still pushing steep spending cuts that the White House won’t countenance, even as the GOP remains deeply divided on a strategy. And we’re now as little as eight weeks away from the “X date” when the Treasury Department no longer has legal authorization to issue new securities and fill up its checking account.

It’s past time for the White House to consider their unilateral options for avoiding economic disaster more seriously.

Perhaps the most prominent proposal to sideline Congress calls for the Treasury to mint a trillion dollar platinum coin and deposit it with the Federal Reserve, ensuring the government has plenty of money to pay its bills. So far, Treasury Secretary Janet Yellen has rejected the idea, warning that the Fed might not accept the coin and that, in her view, the central bank is not legally obligated to accept it.

Read the rest here

I did have a draft of a piece written on financial derivatives for this week, but with everything going on I've decided to delay it. I am flying out to the Bay Area tonight for vacation (say hi if you want!) so I'm taking a break from the newsletter until May 18th. Generally, my experience is that certain kinds of writing are not substitutes for other kinds of writing so I fully expect that, if anything, I will be sustaining a more consistent pace for Notes on the Crises than I did in 2022. There is a lot of "runoff" ideas that are just too complex for the book that is perfect for the type of writing I do here. Expect, especially, a lot of writing about the history of the Federal Reserve's discount window which I've been itching to dig into here.

Anyway, thanks again for all of your support and I look forward to thinking with my readership as I produce and shape the manuscript that will become Picking Losers.

Best,

Nathan Tankus

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025

No spam. Unsubscribe anytime.