How Can We Know if Government Payments Stop? An Exploratory analysis of Banking System Warning Signs

Notes on the Crises pivoted on February 1st into around the clock coverage of the Trump-Musk Treasury Payments Crisis of 2025. Today is Day Twenty Two

Read Part 0, Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10 & Part 11

If you are a current or former career Internal Revenue Service or Bureau of the Fiscal Service Employee and especially if you are a COBOL programmer, contact me over email or over signal (a secure and encrypted text messaging app) — linked here. My Signal username is “NathanTankus.01”. I would also like Legal counsel sources from the Treasury and Federal Reserve as well as payments level sources at the Federal Reserve. I am also looking for sources at FINCEN. Finally If you work at any Administrative Agency and have knowledge of the Bureau of the Fiscal Service directly stopping payments your agency has authorized, please get in touch.

This is a free piece of Notes on the Crises. I will not be paywalling any coverage of this crisis for as long as it persists, so please take out a paid subscription to facilitate performing that public service. You can also leave a “tip” if you want to support my work but hate emails cluttering your inbox or recurring payments. If you’re rich, take out the Trump-Musk Treasury Payments Crisis of 2025 Platinum Tier subscription. The additional thing you get is my continued work to prevent the Treasury’s internal payment system from melting down, Musk taking your confidential information, along with everyone else's as well as my efforts to contribute to the fight against the ongoing constitutional crisis. So far, nowhere near enough rich people are paying their fair share.

Note to Readers: I am on bluesky, an alternative to twitter. It's been hard to let go of twitter since that is where I built my following, but clearly it's becoming less usable and there are obvious concerns about getting traction about a Musk story on the Everything Musk app. I have also started an instagram for Notes on the Crises which is currently being populated with my articles. Audio versions of my articles (read by me personally) will come soon

Finally, I'm known as a crypto skeptic, and I am, but that doesn't mean I won't accept people giving away bitcoin to me. Here's my address: bc1qegxarzsfga9ycesfa7wm77sqmuqqv7083c6ss6

Something I’ve been thinking about from the very first weekend that I became aware of the Trump-Musk Treasury Payments Crisis is one crucial question: how will we know if something big is wrong? Obviously if no payments are going out, that will quickly become clear. But even learning 24 hours sooner could be quite significant. Meanwhile it's possible for a quantitatively large amount of impoundment to happen that falls short of the immediate mass crisis. Early warning signs of this eventuality would be especially helpful. Amidst the insanity I’ve made a number of “deep background” phone calls to sources which may be former or current high level employees of the Treasury, Federal Reserve and/or major banks (no, I will not be more specific than that).

On those phone calls I tried to strategize with my informants regarding every possible angle to understand the possible immediate effects on the banking system and whether there were ways to measure these effects. I only got a chance, between everything else going on, to write up the rough consensus that emerged from those conversations this weekend (it's been a very busy time!)

Before we get to what these sources told me, it's important to run through some more context. Hopefully recent readers of Notes on the Crises have picked up over the past month that the vast majority of government payments flow through the Bureau of the Fiscal Service’s systems. These systems effectively serve as a “payments intermediary” between Federal agencies and the wider economy. I haven’t emphasized how the treasury connects up with the wider payments system but longtime readers will know this part of the story well. Payments run through a Treasury account at the Federal Reserve called the “Treasury General Account” and onto banks who, similar to the Bureau of the Fiscal Service, serve as payment intermediaries. In other words, the government sends you a payment by crediting a bank’s account with the Federal Reserve who, in turn, credits your checking account.

Thus, outlays from the Treasury’s bank account, known as the “Treasury General Account”, are what we are trying to capture when we try to “observe” a failure of the Bureau of the Fiscal Service’s payment systems or the scale of impoundment at the “payments” layer. These outlays are, from the point of view of the banking system, inflows (we’ll get back to this point later). The only current serious effort I’m aware of trying to measure outflows from the Treasury’s bank account is the Hamilton Project at the Brookings Institution. To their great credit, they published a tracker based on the “Treasury Daily Statement” (which is exactly what it sounds like) the late afternoon of February 3rd. For reference, My dual pieces in this newsletter and at Rolling Stone went live at 6 AM that day warning of the crisis. Thus, you can watch outlays from the Treasury’s General Account every day, with only a few days lag. I’ve been aware of this work from early on but have been remiss in giving it the attention it deserves in the newsletter.

Importantly, you also can follow specific outlays using their tracker tool. For example, their accessible presentation of the data the Treasury publishes shows USAID outlays drop to zero on January 28th. Thus, for as long as the Treasury Daily Statement remains accurate (and that is a big caveat), one of the best ways of assessing what’s going on is this tracker. Unfortunately, as they emphasize, outlays are not the same thing as appropriations so you can’t determine exactly how much impoundment is happening. However, this can give us the big picture and tell us when they are crushing specific agencies. The nagging question amidst all of this is: what about the integrity of this data? After all, the source of this data is… the Bureau of the Fiscal Service. Marko Elez may have been bounced out (and now at the Social Security Administration) but there is very little reason to think this is the end of this over the course of the second Trump administration.

Which leads to the line of inquiry I pursued with my sources. The perspective I took when discussing this with them from three weeks ago is an opposite, but mirrored angle to the mode of analysis the Hamilton Project took. Instead of examining things from the perspective of what the Treasury daily statements are (or would be if not manipulated), I thought about this in terms of the effect of fluctuations in the Treasury’s general account on the banking system. In other words, the Hamilton Project focused on the outlays from the Treasury’s bank account while I’m focusing on these same flows as inflows into the banking system.

This is where accounting is key. For every sale there is a purchase. For every outlay there is a receipt. For every net outflow there is a net inflow. Thus the rise or fall in the Treasury’s account must be matched by a fall or rise in some other entity’s account with the Federal Reserve. Alternatively, it may be matched by a rise or a fall in the Federal Reserve’s liabilities themselves. In other words, every liability is someone else’s asset.

Regular readers know that my analytical lens (but not my end-point) is a school of thought called Modern Monetary Theory (known academically as Neochartalism). MMT has, from its inception, emphasized the role of taxation and spending on the level of “settlement balances” in the banking system. Fair warning, this is going to get wonky and in the future I will have to bring back my monetary policy 101 series to fully run through all these details when the most acute phases of the current crisis passes.

“Settlement balance” is a European phrase for funds in accounts at a central bank that I use because I think it's clearer than the alternatives. Another way of saying the same thing is that settlement balances are the “book entry” IOUs that central banks create when making payments. In simpler terms, money. If government budget deficits were purely a matter of the injection of settlement balances they would increase the total amount of balances held by the banking system. From this perspective, modern government issued securities are a monetary policy tool which drain settlement balances from the banking system.

That the Treasury more or less issues treasury securities to match net payment outflows from the Treasury General Account over time ensures that over long periods of time the Treasury does not increase the overall level of settlement balances in the banking system, allowing the Federal Reserve to control this variable. On the other hand, over the past 20 years or so the Federal Reserve has gained more tools to control the level of settlement balances in the banking system on its own and could be given the authority to issue its own securities. You can read more about this in past articles here, here and here. I especially recommend my 2020 piece “The Federal Government Always Money-Finances Its Spending: A Restatement” which runs through many of the concepts utilized here using “T accounts” which lay out the complete accounting step by step.

The Federal Reserve's current monetary policy operating procedures are known today as the "ample reserves" framework because they aim to provide the banking system with plenty of settlement balances in the hopes that factors that affect the banking system’s need for liquidity over short periods of time will “take care of themselves”. The operating procedures from before the Great Financial Crisis are sometimes called a “scarce reserves” framework but I would prefer to call it a “limited reserves framework” or, better yet, a “limited settlement balances” framework. In the “limited settlement balances” framework the Federal Reserve would use repurchase agreements and reverse repurchase agreements (we’ll get back to what these are in a bit) to modulate the level of settlement balances in the banking system on a daily or intraday basis.

They did this to adjust the level of settlement balances in the banking system when needed for monetary policy purposes, but more often they did this to account for factors outside of their control changing the level of settlement balances. These factors outside the control of the central bank are known in the central banking literature as “autonomous factors”. When you quantify these factors to look at their overall effect on the level of settlement balances in the banking system they are referred to as “net autonomous factors”. This leads to the accounting identity:

Settlement Balances in the Banking System = Net Autonomous Factors + Net Borrowing from the Central Bank + Net Central Bank Purchases

This is known as a “stock” measure because it measures the overall level of all these variables at a point in time. Think of the water level of a bathtub. This can be turned into a “flow” measure which measures change over time. Think of the rate at which water flows out of the bathtub’s faucet or the degree to which the water level of the tub has risen. To represent change I will be using the conventional symbol- a delta Δ:

Δ Settlement Balances in the Banking System = Δ Net Autonomous Factors + Δ Net Borrowing from the Central Bank + Δ Net Central Bank Purchases

From here, it should be clearer why, in a limited settlement balances framework, the central bank’s daily work involves adjusting for factors outside their control.

If you have a “target” level of settlement balances in the banking system then “net autonomous factors” can move that variable away from its target. You are successful when “Δ Settlement Balances in the Banking System” is zero which means central bank actions have to always be an opposite mirror image of the net autonomous factors. If they inject settlement balances, you have to act to remove them. If they remove settlement balances, you have to act to inject more. There are a few so-called “autonomous factors”, notably orders of physical currency by the banking system. The most important “autonomous factor”, however, is the change in the Treasury’s account (or accounts) at the central bank. Thus in a limited settlement balance framework the biggest daily factor the Federal Reserve adjusted for was volatility in the Treasury’s General Account (TGA).

Which brings us back to Repurchase agreements. Repurchase agreements are just a fancy way of lending against Treasury securities as collateral. A collateralized loan can be structured as an agreement to buy a security (or other property) while also being issued a promise to buy back that security by the seller at a set price. The difference between the selling price and the repurchase price can implicitly contain an interest rate while the fact that the creditor technically owns the treasury security outright means (under current law) they can just keep it if the other party defaults on the promise to repurchase it. If it were legally, and not merely economically, a collateralized loan they might have to hand the collateral over to a trustee who would sell the collateral and compensate other creditors with a higher priority in bankruptcy. In the lingo of the financial world a “repo” agreement takes the perspective of the lender so if you want to describe the borrower’s perspective you call a repurchase agreement a “reverse repo” agreement.

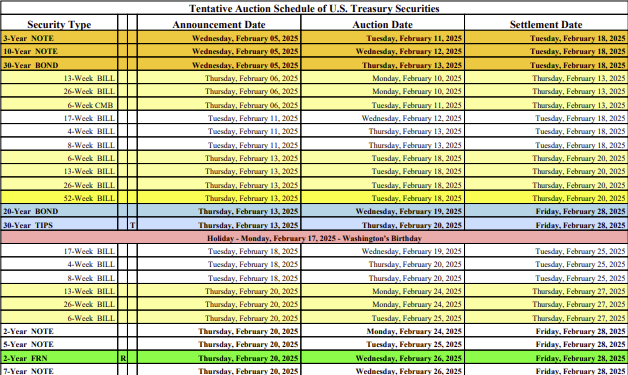

The Treasury holds auctions of Treasury securities throughout the month but these auctions only settle at a few regular dates. In the “limited settlement balance” framework of the past that meant entering repurchase agreements to inject settlement balances prior to the auction settlement draining them right back out. Once outlays from the Treasury’s “checking” account injected settlement balances again the Federal Reserve would reduce its “repo” activity with the goal of keeping the banking system’s settlement balances at the “target” level.

The fact that Treasury auctions only settle at a few specified times over the course of a month means that those auctions are mostly not the cause of the volatility in the Treasury’s “checking” account with the Federal Reserve. To break down what this means in concrete terms, on “auction settlement dates” the Treasury General Account balance goes up a lot and (assuming a typical period of deficit spending) gradually declines over time with erratic jumps up and down because of outlays and revenue inflows erratically changing each day. A crosscutting factor here is payroll and scheduled social security payments- these go out in large amounts at the beginning of each month. Overall though, volatility is kind of the meeting point between these two “scissors”. From the perspective of what we are concerned about here, this also means we can sidestep the question of treasury auctions.

In my conversations across quite a diverse array of sources, some initial hypotheses have reached general consensus. That is, a sign of large quantities of spending not going out is a fall in the volatility of the Treasury’s general account’s daily balance because volatility comes from both the tax and the spending side and not the treasury issuance and settlement side. Thus the TGA’s overall volatility is the product of the volatility of both these factors and if you take the volatility experienced in the past couple of years as a baseline, major drops in outlays will lead to less volatility.

Further, since the Federal Reserve is no longer using a “limited settlement balance” framework and instead using an “ample settlement balances” framework, we shouldn’t expect “net autonomous factors” to be adjusted for. Indeed, this is likely an important part of “Repo Madness” in 2019. Before all hell broke loose, I was planning on spending February writing, in part, about “Repo Madness” utilizing the 2019 Federal Open Market Committee transcripts and Federal Reserve memos which has just been released six weeks ago. For now, it's sufficient to state that they are not trying to precisely adjust for “autonomous factors” and their impact on the level of settlement balances in the banking system.

The practical consequences of this for keeping a close eye on what is going on with the Treasury’s checking account is that fluctuations in its balance should have a roughly 1 to 1 impact on the banking system under the current monetary policy implementation approach. Thus, if large scale impoundment happens there will be less outflows from the Treasury’s account at the Federal Reserve. This will then lead some proportion of banks to overdraft their accounts over the course of the day, which is referred to as an “intraday overdraft”. This means that “aggregate” or “total” intraday overdrafts of the banking system as a whole will increase. Many bankers will suddenly need to cover outflows usually covered by inflows of government spending into the banking system.

This leads to an area where there is some debate among my sources over whether the consistent lack of inflows of government spending would lead to greater hoarding of liquidity in the banking system. The debate revolves around whether the Federal Reserve would have to adjust the way it implements monetary policy to “accommodate” the sudden loss of these regular inflows. The “unconcerned” perspective essentially takes the view that large intraday overdrafts would keep happening but bankers would "settle up" on an overnight basis and be able to find the new funding they need without changes in the banking system’s overall liquidity behavior. The “Fed adjustment” view thinks that a game of “hot potato” may emerge as bankers delay outgoing payments they can legally delay in an attempt to hold onto liquidity and this knock on effect leads to “aggregate” liquidity hoarding.

As someone interested in the nuts and bolts of payments systems and monetary policy implementation I find this “debate” I’ve been serving as a kind of “anonymous clearinghouse” for quite interesting. However, for most readers this debate is irrelevant. My sources all agree that an early sign would be far greater intraday or “daylight” overdrafts across the banking system. Further, we have no public “real time” measurements for this the way we do for the Treasury Daily Statement. Nor is there an “indirect” measure we have a real time measure of.

Let me make my next few statements very carefully. If I have high level current Federal Reserve or Banker sources, I’ve encouraged them to construct measures of the number (and total quantities) of government ACH payments coming by on a daily, weekly etc basis. Whether or not I have such sources, I encourage any readers who fit this description to construct such measures if those measures do not already exist. I also encourage all high level bankers & Federal Reserve employees to pay attention to the total intraday overdrafts being taken by either their bank or by the banking system (in case of a Federal Reserve reader).

Getting a source or sources to report “real time” Federal Reserve measures of daylight overdrafts would be the most helpful and consequently the most unlikely. Banker sources may be less tight-lipped than Federal Reserve sources and be willing to confidentially inform me if intraday ("daylight") overdrafts are regularly rising. Hopefully, however, writing this all publicly will push individuals and institutions across the financial system to take these measures more seriously and maybe that will indirectly get that information out there in more indirect ways.

Finally, the other complication is, of course, if they start messing with things on the tax side. They seem to have backed off of the Internal Revenue Service operationally for now, but if they start messing with tax collection then it will be far more difficult to divine what is happening from fluctuations in the Treasury’s “bank account” volatility. As an aside, I am still looking for more Internal Revenue Service sources, especially those with expertise in how their legacy IT systems work (or their modern data processing systems work for that matter). I have a number of sources, but need much more and I am hoping to build up expertise in this area over the next few months under the expectation that DOGE is not done with these systems.

Overall, I’ve found this “exploratory analysis” quite helpful and I hope it's also helpful for readers. Thank you to all the sources who talked with me and if you are someone who fits the broad, vague description of my sources and would like to give your own thoughts, contact me over the encrypted text messaging App Signal under the username NathanTankus.01.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025