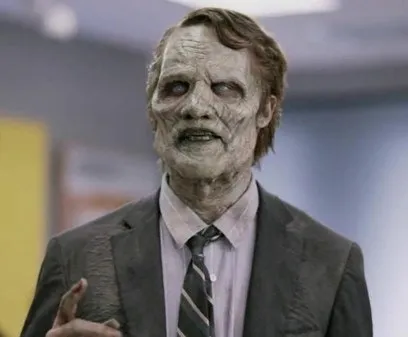

Should We Start Shooting ‘Corporate Zombies’?

Ever since the era of risk free Zero Interest Rate Policy began with the Great Financial Crisis, there have been a number of different arguments which have popped up in the mainstream economic policy debate about “negative side effects” of this policy. Keeping interest rates low for long periods of time sits uncomfortably within mainstream economic theory, given the overwhelming effect interest rates are supposed to have on investment decisions. More fundamentally, there is a clear instinct engendered by much economics education that such an administered government policy should be leading to a harsh misallocation of resources. I documented and criticized one such argument, and in the process laid out reasons to be skeptical towards the influence of interest rates on investment decisions, a few weeks ago.

None of the above rules out the possibility that low risk free rates can have negative side effects. For example, I’ve written before that I think institutional investors have been negatively impacted by low risk free nominal rates and may be making some undesirable portfolio allocation decisions as a result (I plan on writing about this issue more in the future). My larger concern is that the overwhelming desire to focus on low interest rates to the exclusion of all other factors leads to a distorted economic policy picture which distracts from our larger problems. Many of the problems that are taken to be coming from “too loose” interest rate policy are in fact problems of insufficiently expansionary fiscal policy.

Today’s topic is another example in this genre. One of the big alleged side effects of low interest rates are the propagation of “zombie firms”. These firms limp along when they “should have died”, misusing resources. However, while the idea of “zombie firms” is very associated with misusing resources, it is neither defined this way, nor is there a simple and obvious measure of “resource misuse” that researchers point to as easily being able to identify “zombie firms”. Instead, researchers posit financial definitions of zombie firms. For example, Bank for International Settlements researchers Ryan Banerjee and Boris Hoffman say that zombie firms are defined as “firms that are unprofitable but remain in the market rather than exiting through takeover or bankruptcy”. In the abstract of their paper they summarize their way of measuring this as “unprofitable firms with low stock market valuation”.

Defining “zombie firms” financially raises a number of problems. Since the financial situation of companies is driven by sales, financial weakness is also related to demand conditions. In typical recessions, especially deep recessions after severe financial crises, sales fall precipitously and then recover at painfully slow rates. It is very easy to blame companies for weakness that is driven by overall economic conditions. The sources of aggregate profits, which I described in my introduction to the Kalecki-Levy profits equation, condition possibilities for profitability and sales growth of individual firms. Would driving financially weak firms out of business with higher interest rates when their conditions are primarily driven by macroeconomic conditions be a good decision? There is also the danger that those businesses failing, and the higher interest rates themselves, would simply make firms that avoided “zombie” status after the great recession into zombies. The best way to solve zombie status to me is adequately expansionary fiscal policy.

Nonetheless, it may be the case that financial weakness begets financial weakness even if overall demand conditions improve and that financially weak firms do need reorganization and reduced debt loads. If this is true, it seems to me that this is a sign that bankruptcy laws need to be loosened instead of tightening monetary policy. If heavily indebted firms have easier recourse to bankruptcy and more protection in bankruptcy, creditors are less likely to sustain them past their “sell-by dates”. To use the metaphor in the title of this piece, instead of shooting corporate ‘zombies’ we should give more of them the vaccine. Easier access to bankruptcy for the private sector more generally helps the economy deleverage quicker and makes firms and households less reliant on expansionary fiscal policy to rebuild financial net-worth.

The other problem with the “corporate zombie” question is the matter of “productivity”. The evidence that resources are being misallocated by allowing financially weak firms to limp forward is that these firms have “lower productivity” than other firms. This is a big topic which I can’t possibly tackle in full now, but a big problem is that the measure of “output” is sales. With the numerator driven by macroeconomic conditions, researchers also have to be careful to avoid attributing macroeconomic conditions to individual firms when talking about “productivity”. Productivity can fall because sales fall and firms decide to retain staff.

This of course is at its most extreme in the Coronavirus Depression when a firm can be subsisting on Payroll Protection Program support without having any production at all. As Professor JW Mason wrote in 2016, measured aggregate “productivity growth” fell after the Great Financial Crisis in the United States, driving 75% of the decline in “real GDP growth” (a concept we will tackle another time). He makes a very convincing case that the productivity growth slowdown is not a random “exogenous” event that coincides with the great financial crisis, but driven by the decline in aggregate demand. If we think that absolute demand weakness drives absolute financial weakness while market leaders are more likely to be relatively financially strong, we would expect that the financially weakest firms in an industry would see the steepest declines in sales. While I can’t prove it here, I strongly suspect that measured “productivity growth” falling more among so-called “zombie firms” is a microeconomic manifestation of the macroeconomic story that JW Mason is telling.

It’s also worth saying that the “zombie firm” mechanism works in the opposite direction of the Mian, Sufi and Liu paper I discussed a few weeks ago. In that paper, market concentration was driven by encouraging market leaders to “internally grow” i.e. gain market share while discouraging “market followers” from doing so. While informally many, including former FDIC chair Sheila Bair, have connected this to low interest rates encouraging mergers and acquisitions, the “zombie firm” connection suggests that there are firms “limping along” who would otherwise go through bankruptcy or be acquired at distressed prices. The latter almost certainly is more likely to lead to concentrated markets, though I suppose there is an argument that being forced into bankruptcy quickly will potentially lead to a more competitive firm, capable of retaking market share. I would be interested in work that attempted to cohesively tell all these different stories about the negative side effects of low interest rates at once.

Looking at this story in more detail, it seems to me that this is likely an example of a spurious correlation. It is the collapse in aggregate demand which is causing both the fall in sales and lower interest rates by compelling the central bank to lower interest rates. The fall in sales is in turn causing financial weakness in companies and lower measured productivity growth. My argument here will need more statistical (and qualitative) investigation so I don’t want to imply that this article is the “definitive” takedown of the “zombie firm” narrative, but there are many reasons to be skeptical. I certainly don’t think there is yet a compelling case that low interest rates are having a host of negative effects that “outweigh their benefits”. The problem is a lack of expansionary fiscal policy, not low interest rates.

Subscribe to Notes on the Crises

Get the latest pieces delivered right to your inbox