The Big Unanswered Questions about the Federal Reserve's Coronavirus Response

What We Simply Do Not Know

Originally today’s post was going to be Part 4 of my series on what the Federal Reserve’s crisis actions have been (see Part 1, Part 2 & Part 3). However, what I realized today is that as of right now what is far more interesting and important than what the Federal Reserve has announced and is doing is what it hasn’t yet done and what is unknown about what it's already announced. Hence, I reused some material from the Part 4 post here and will go live with that one next week (hence why this post is coming late in the day). In this post, I will go through these big unanswered questions which we must have the answer to in order to know the shape of things to come.

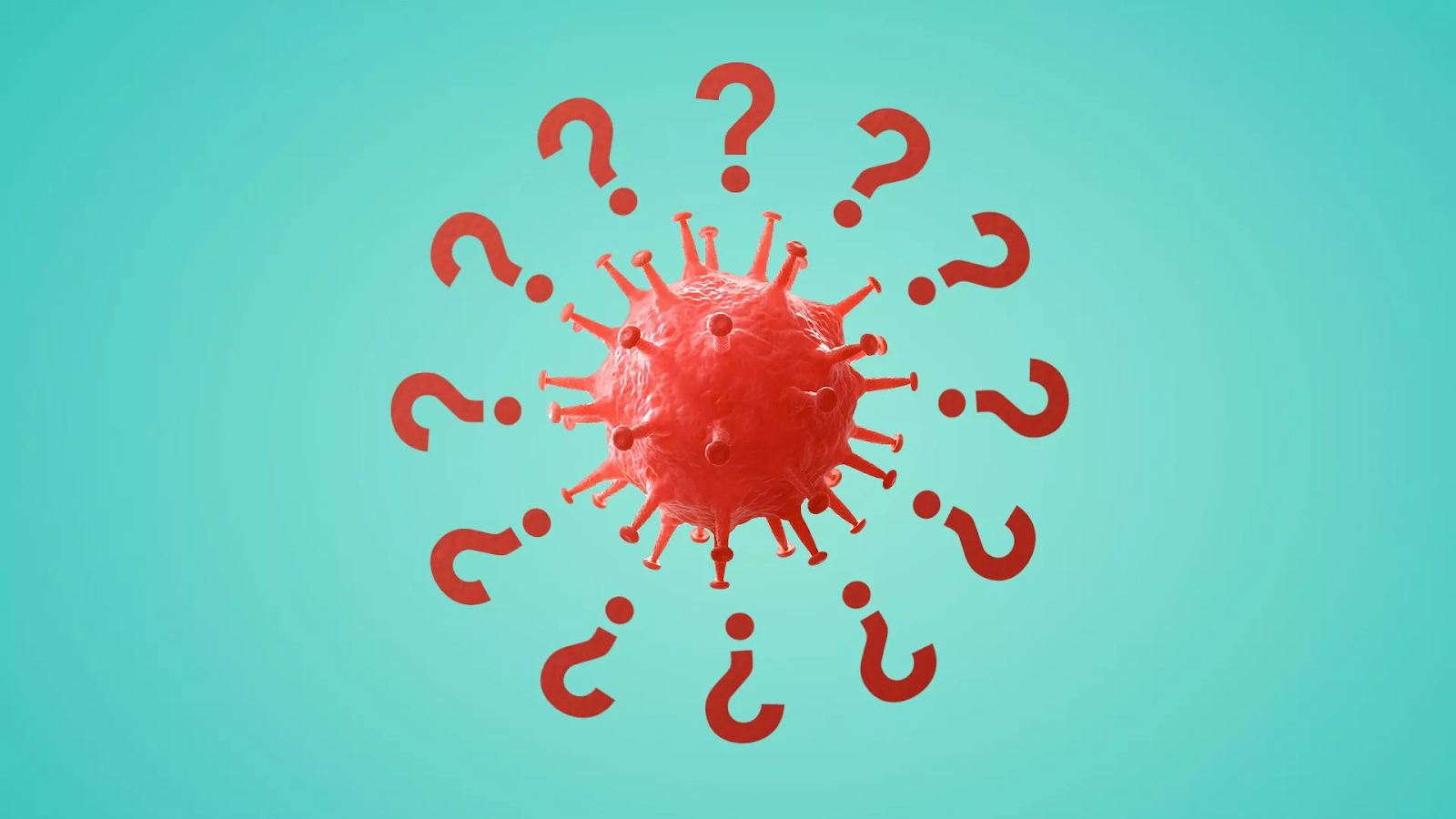

Before we do this though, it's important to take a step back and remember what this is all about. We’re talking about the actions that (along with Congressional action) determine the extent to which we A) prevent deaths from Coronavirus B) prevent economic-related distress, suffering and death and C) preserve the legal-economic relationships which keeps our production structure intact. How are we doing by these metrics? Seemingly not very well when we look at the sheer scale of unemployment right now

The unemployment claims announced today is double what it was last week, which was a staggeringly large number already. The two weeks combined is a little over 3% of the entire U.S. population. The great recession is barely a blip when compared to the size and the speed at which this depression has happened. As I said almost 2 weeks ago:

What worries me the most about this kind of thinking is many who seem attracted to it don’t seem to realize how unprecedented a crisis this is. This is no mere recession. This is not even the Great Depression. This is the largest, fastest economic crisis that has ever happened. We’re hanging on a precipice and we need 3.5 trillion dollars distributed to households at a minimum- let alone the support system we need for businesses. The estimates for how many unemployment claims we’ll have from this week is so high that the 2008 peak barely even registers as a blip in comparison. This is the biggest crisis we’ve ever faced and we need quick responses with trillions out the door now. We weren’t necessarily going to experience a recession any time soon but we’re in a depression now and we need to respond accordingly.

We have yet to get a response to the crisis that comes close to matching the speed and the size of this crisis. While congress has done worse than the Federal Reserve, the Federal Reserve has not done enough. In particular, the programs aimed at helping the sectors that need it most- small and medium sized businesses, state and local government- have yet to be launched. In fact, a municipal debt purchase program has not even been announced.

What is the structure of the Main Street Lending Program?

Every program up until now has been direct support for a component of the financial system or large non-financial corporations. According to the Federal Reserve’s announcement on March 23rd, we are going to get a different type of program “soon”. They refer to this program as a “Main Street Lending Program”, though we have very few confirmed details about it. Yesterday the president of the Federal Reserve Bank of Boston Eric Rosengren said that the program was still “two weeks away”.

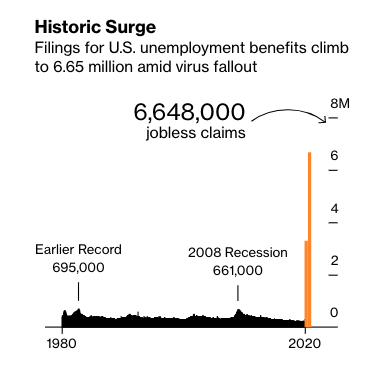

Joseph Brusuelas, chief economist at consultancy RSM, believes based on a series of Federal Reserve official comments that the Main Street Lending Program will be capitalized to the tune of 85 billion dollars, making for a roughly trillion dollar lending program. This sounds “right” given the size of their other facilities so far and the needs of the sector being targeted but the reality is it will be a while before we know for sure.

As his chart below shows, the program seems like it will work by (like the SBA emergency program) having U.S. banks originate loans and sell loans to the Special Purpose Vehicle associated with the program (it is unclear whether all loans will be sold to the SPV or whether only “non-performing” loans will be sold). Like with the SBA program, there are concerns about how the loans will be serviced given the poor track record of U.S. banks as mortgage servicers. It is also very important to know how the program will be overseen, which we do not yet know.

Some of the most helpful information about the program comes from the FAQ created by Maxine Waters’s House of Representatives Financial Service Committee:

“Two provisions within the CARES Act would encourage the Federal Reserve to stand up such a program. One provision instructs the Treasury Secretary, with the Federal Reserve, to create a facility where banks and other lenders would receive financing to lend to mid-sized businesses. The law defines eligible businesses as those having between 500 and 10,000 employees, and also includes nonprofit organizations. The suggested program would cap the annual interest rate on loans at two percent, and the Treasury Secretary could provide forbearance on loan payments for six months or longer.

To apply, businesses would have to make a good faith certification that it will meet ten conditions, including: the funds will be used to retain at least 90 percent of the recipient’s workforce, at full compensation and benefits, until September 30, 2020; the entity will not offshore jobs for the duration of the loan plus two years; the business will not pay out dividends or buyback shares for the duration of the loan; and the entity will not abrogate existing collective bargaining agreements for the duration of the loan plus two years. (See here for a full list.)”

While 2% interest is low, it is hard to imagine businesses taking up these loans given their terms and conditions unless it was literally a choice between bankruptcy and this credit. This is especially the case for small businesses given the much more favorable terms of the SBA forgivable loans. Despite economic policy circles’ obsession with “bridge loans”, what has happened is a collapse in demand and thus income for small businesses. Piling on debt (and reducing financial net worth) is better than total collapse but it leaves these businesses in extremely precarious positions.

Will these loans be treated as conventional loans or will they be more generous in terms of declaring suspensions and holidays for payments for distressed debtors? We simply don’t know. What we do know is that the Federal Reserve is not using its regulatory powers to compel banks to cancel mortgage and other debt payments during the Coronavirus shutdown. While, as we discussed in Part 2, they have said that “loan modifications” will not count as “Troubled Debt Restructurings”, banks still have full discretion to decide whether they’ll waive mortgage payments. This shouldn’t be the case. As Skanda Amarnath argued earlier this afternoon, financial regulators should be informally discussing with banks about the need for them to declare suspensions and holidays. When necessary, they should also threaten them with negative regulatory treatment, up to and including raising capital requirements, in order to compel them to declare such suspensions and holidays.

While I think the Federal Reserve should simply accept losses, and the accounting gimmicks surrounding treasury capitalized special purpose vehicles are silly, if we must have this convoluted charade then at the very least it should be used to do what its best at- taking losses. Purchasing loans that we want partially cancelled or otherwise restructured seems far more useful than what they are planning to do with the Main Street Lending Program. Businesses don’t need more debt, they need increases to their disposable income. Ironically, in this circumstance something like a Troubled Asset Relief Program (as originally envisioned) makes sense. If we’re worried about moral hazard we can impose liquidity requirements on non-financial businesses, like I discussed Tuesday. We can even impose capital requirements on these entities.

When are we going to get a municipal and state debt purchase program?

The worst element of the Federal Reserve’s response to date has unquestionably been its failure to respond to the fiscal crises Coronavirus has created for state and local governments. The excellent New York Times Federal Reserve reporter Jeanna Smialek wrote a piece which recounts in infuriating detail why the Federal Reserve has been so slow to “intervene” into municipal debt markets. They are worried about picking winners and losers (which apparently is only a concern with this market and no others…), taking losses and the idiosyncratic nature of the municipal and state debt markets. These concerns are not very compelling. The most powerful thing the Federal Reserve can do in this moment is prevent state and local government austerity. The distributional consequences of letting high unemployment and collapsed social services (especially healthcare spending) accrue is far higher than “subsidized” interest rates to governmental organizations. Finally, if they do primary market purchases than it doesn’t matter how the overall market is structured. Municipalities themselves can buy back their own debt.

Because of their delays and hesitation, it's hard to know how their eventual program will be structured. How extensive will purchases be across the board? Will there be an accompanying lending program? How long will they commit to the municipal market for? Will they, like conventional quantitative easing, commit to rolling over the securities they purchase? I think that they should use their existing authority because it is only their existing authority which gives them the legal powers to make credible commitments. They should commit to purchasing tax anticipation notes directly from municipalities and state governments up to a quantity equal to 150% of the entity’s highest outstanding level of debt over the previous year (i.e. similar to the Corporate Credit Facilities). A higher ceiling could be necessary. They should then commit to rolling over those tax anticipation notes over the next thirty years at the same price, effectively synthetically creating a 30 year security. I will be writing about this in more detail on Monday.

If they don’t use their credibility in this fashion (which is the only true way to mobilize credibility to increase demand) then it will be difficult for the Federal Reserve to prevent the budget cuts that are coming down the pipeline as a result of collapsing tax revenues. The Federal Reserve has the capacity to convert America’s Governors from vicious austerity to the doctor’s principle of “do no harm”. That is, at the very least, politicians willing to do emergency spending separate from their budget balancing inclinations. What the Municipal and state debt facility is and how quickly it comes is the biggest question mark about the Federal Reserve’ future actions. This means we ultimately are missing the information we need to judge how well they are responding.

Will the corporate debt facilities introduce “grandfathering” clauses?

Credit downgrades are accelerating in the US and, crucially, they are tipping increasingly large # of firms out of IG-BBB into HY, removing them from Fed safety net and tightening credit terms. @creditsights via @SoberLook pic.twitter.com/rpk2u1QXZM

— Adam Tooze (@adam_tooze) April 2, 2020

As Tooze points out above, credit rating agency ratings of corporate debt falling below investment grade technically removes them from eligibility for the Primary Market Corporate Credit Facility and the Secondary Market Corporate Credit Facility. This reduces the capacity for these programs to help prevent corporate debt interest rates rising. It is doubtful that this situation will be allowed to continue, particularly given the precedent set with the Commercial Paper Funding Facility. As I discussed in Part 2, “The second change [to the facility on March 23rd] adjusts for worsening credit conditions by “grandfathering in” corporate securities that were at the minimum eligible rating on March 17th but subsequently lost that rating in the last 9 days”. In fact, the mysterious thing here is why this wasn’t already part of the announced criteria for the program. The possibility that pre-Coronavirus investment grade securities wouldn’t be grandfathered in at all seems like a very large unforced error in an otherwise competent crisis response.

What will be the relative proportions between all these different programs?

One of the biggest misconceptions about the forthcoming Federal Reserve lending programs by those who have only a passing familiarity with the Federal Reserve is that it is pursuing a “4 trillion dollar corporate bailout”. There is little evidence that this is the case and it seems to have spread through the power of pure repetition. The truth, in fact, is that we have no idea how big each facility is ultimately going to be. The current capitalization for the special purpose vehicles created for the Primary and Secondary Market Corporate Credit Facilities is 10 billion dollars each but that was with funds from the Exchange Stabilization Fund, not the recent legislation. Under the widespread theory that there will be ten dollars of lending for “each dollar of equity”, that would mean 200 billion dollars of corporate debt purchases. That’s far away from the 4 trillion dollar number. Of course, this program can and likely will be expanded. However, a number of other facilities will “need” capitalization given the Federal Reserve’s successful propaganda claiming it “must” avoid default losses.

As we discussed above, it is suspected that the Main Street Lending Program SPV receives 85 billion dollars of capitalization. That is 18.7% of the funds allocated by the “stimulus bill” for Federal Reserve programs alone. We still have a municipal and state securities market program that has yet to be announced and will likely “require” significant capitalization. It’s not exactly clear that the facilities targeting corporations with investment grade debt will be expanded at all, though it seems likely they will. It’s even possible they’ll launch a separate vehicle for supporting non-investment grade, large corporations that aren’t already receiving a bailout from congress.

Conclusion

The fundamental point is we simply do not know how this is going to play out and what the ultimate breakdown of lending and purchases is going to be between the mind bendingly wide variety of programs. While I am frustrated with the misconceptions and myths that are being spread by some liberals and leftists, it is hard to blame the mistrust of an organization famously resistant to oversight and clarity like the Federal Reserve. Especially as the bill repeals open access meetings and records keeping regulations on Federal Reserve related programs and the capitalization fund is similar in structure and “after the fact” oversight to the Troubled Asset Relief Program. At a minimum, the Federal Reserve should announce how much each facility will be allowed to purchase even if they don’t have all the details worked out and the facilities themselves wait for another week or two. There are far too many unknowns right now and that uncertainty is dragging down the power of their crisis responses.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025