The Federal Reserve’s Monetary Policy Operating Procedures Have Come Full Circle: What Does that Mean for the Post-SVB FOMC Meeting?

Before Silicon Valley Bank failed last week, I was considering writing a post examining the Federal Reserve’s policy framework in the context of the last sixty years of monetary policy’s history. That kind of analysis is now newly relevant, perhaps even urgent given the Federal Open Market Committee (FOMC) meeting today, and the press conference Chairman Powell will hold tomorrow. Recall that the FOMC is the committee that determines monetary policy within the Federal Reserve.

Today it is widely accepted that the Federal Reserve uses one main tool (interest rates) to affect the economy through the “channel” of “financial conditions'', in order to accomplish its twin goals of high employment and low inflation. Of course, in practice, it’s choice between those two goals when they conflict leans much more heavily towards inflation. In some historical periods, it seemed to be the case that they only cared about inflation. However, that is not what this piece is about. Instead I want to focus on those first two parts: tools and “channels''.

Both these terms, “tools'' and “channels”, are relatively clear and intuitive, but imprecise. In debates over how to operate monetary policy between the 1960s and 1980s, more precise terms emerged in the debates between central bankers and academic economists. The first of these terms is “operational target”. The idea here is that you can state goals, but they don’t have much meaning without a way to accomplish them. An operational target is something you can concretely accomplish which will impact the economy and (presumably) somehow lead to accomplishing your goals. The most obvious operational target is the setting of the federal funds rate, the overnight interest rate chartered banks charge each other to lend funds.

Why is this an “operational” target? It’s because the Federal Reserve has concrete tools it can use to directly set this interest rate while… wait why should anyone care about this interest rate? This is not the interest rate on your credit card, on your mortgage or any other important financial market businesses and households interact with. Furthermore, as economist William Dunkman pointed out in his book Qualitative Credit Control as much as 90 years ago, it’s not even a significant cost for banks (most of the time). Most of the liabilities that “match” the assets banks hold are not federal funds, or discount window borrowing (again, today is a little bit different!). No one outside of the banking system is able to borrow on the Federal Funds market at the Federal Funds rate.

So why does the federal funds rate matter? This brings me to the second term those debates produced: “intermediate target”. An intermediate target was something that you attempted to affect with your operational target in order to accomplish your larger goal(s). Thus, to take the simplest example, other interest rates besides the narrow federal funds rate could be taken as the “intermediate target”. Deposit rates and loan rates may increase because the Federal Funds rate has increased. Interest rates on short maturity securities will change, but so will interest rates on longer maturity securities. Some other financial markets may even set their own interest rates as a “mark up” on the federal funds rate. The key to understanding the difference between an operational target and intermediate targets is that operational targets you have direct control over (or at least you believe you have…) Whereas intermediate targets can be varied, and may not behave exactly in line with operational targets. That is, to be intermediate targets they must be affected by your operational target, but other factors may impact them as well.

It’s beyond the scope of this piece to talk about the Federal Reserve before and during World War Two, so I won’t! In fact, I’m just going to start my story here in the late 1950s for convenience. By this point the Federal Funds market had become a significant market, though the discount rate still mattered (that’s the interest rate on loans at the discount window i.e. for direct borrowing from the Federal Reserve). In fact, from within the Federal Reserve by the mid-1960s it was thought that private actors were overly focused on the discount rate relative to the federal funds rate. But that is a story for another time. What matters for the purposes of my story today is that the Federal Reserve is moving interest rates around to impact financial conditions and thus the broader economy (it's actually more complicated than this, I can only cover so much in one piece!)

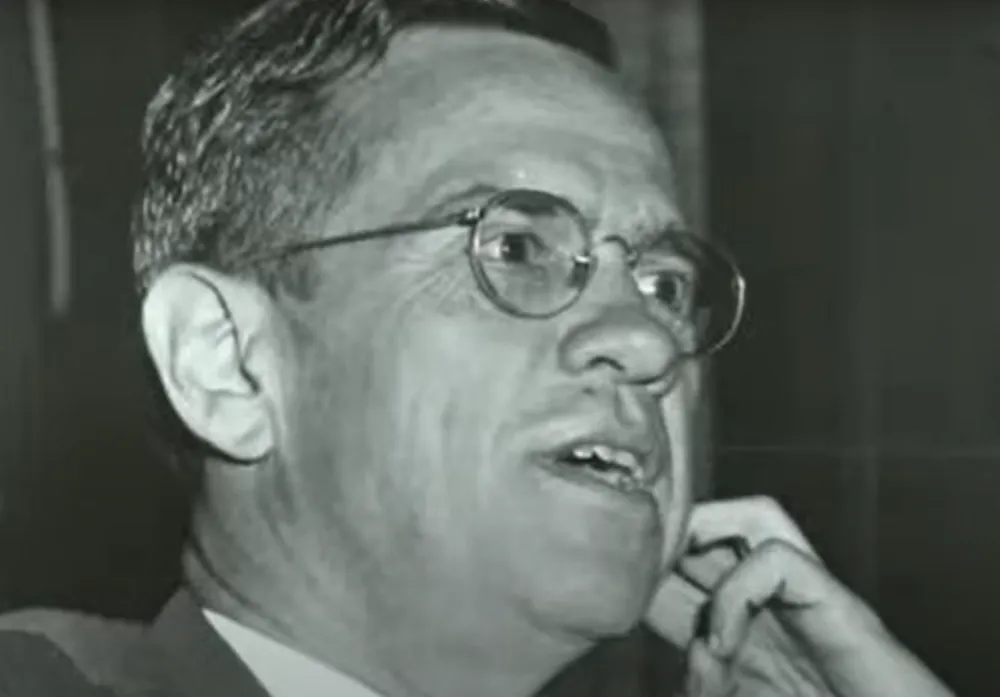

Yet the Federal Reserve under William McChesney Martin, Federal Reserve chairman from 1951 to 1970, at this point is not thinking in terms of this schema. They don’t clearly think in terms of using an operational target (though they have one) to impact an intermediate target in order to accomplish their goals. In fact, they were frequently pilloried for not having a framework at all. G.L Bach, a now forgotten, but at the time quite well known monetary policy economist, said in a congressional hearing in 1964:

The Federal Reserve has not made it clear that it has a clear, explicit framework, or rationale, for its monetary policy, specifying the mechanism or steps connecting particular Federal Reserve policy changes with the desired end results. [...] But without firm knowledge of the links connecting Federal Reserve actions with their immediate targets (for example, free reserves or interest rates) and in turn with later goals (for example, the money stock or availability of credit) and with ultimate objectives (employment, output and prices), neither Federal Reserve officials nor the public can be at all sure of the appropriateness of particular policy measures.

This criticism is valid. In retrospect, looking from the vantage point of the Federal Reserve’s current operating framework, it's easier to see that the Fed’s core operational target was the Federal Funds rate (with some help from the discount rate) and the Fed’s core intermediate target was “financial conditions”. But at the time, especially to the monetary economists of the era, it seemed that the Federal Reserve had a multitude of intermediate targets, and no clear causal connection from one step to another.

Martin, who started out as a New York employee of a St. Louis financial firm in the late 1920s and through much of the Great Depression, worked his way up to being president of the New York Stock exchange in a peculiar set of circumstances. After the war he became the first head of the Import-Export Bank and then a deputy treasury official. The point is, he came to the Federal Reserve with a wealth of practical financial market experience. That experience made a focus on financial conditions quite natural. He had done graduate study in economics at Columbia University, but he focused on practical study of the New York Stock Exchange. He had good reasons to make policy the way he did, but he couldn’t articulate them in ways that satisfied economists and the qualitative, intuitive knowledge he was relying on is not something that can be easily judged from the outside.

Of course, the other element here is that in the 1950s and 1960s there was a belief that “optimal control” over the economy was both possible and desirable. Academic economists were not going to tolerate the Federal Reserve’s, or Martin’s, vagueness in such an intellectual environment for long.

Naturally, these academic economists were not simply criticizing the Federal Reserve about process issues. They had their own views on what the Federal Reserve’s operational and intermediate targets should be. G.L. Bach may be forgotten now, but one of the other economists at that hearing is more well known today: Allan Meltzer. Professor Meltzer was a well known monetarist, even going so far as to start a “Shadow Federal Open Market Committee” with some other economists to provide a “monetarist alternative” to Federal Reserve actions in 1973. Thus, greatly improving the Federal Reserve’s process was tied to making the Federal Reserve focus more directly on the “money supply” and to use money supply measures as a target. Monetaristesque ideas also appealed within the Federal Reserve and in congress for more basic issues of government accountability. That is, a quantitative target was something concrete and understandable and you could check whether the Federal Reserve hit its target or not. Financial conditions, especially as the 1950s and 1960s Federal Reserve discussed them, had a level of vagueness which made quantitative oversight quite difficult.

There is also the matter of the accountability of the New York Federal Reserve’s trading desk to the rest of the Federal Reserve, let alone Congress. It is difficult to think about or understand now, but the “desk” had quite an amazing amount of discretion up until (roughly) 30 years ago. Even though the Federal Reserve was effectively targeting interest rates in the 1960s, they did not announce any interest rate target changes at FOMC meetings which then had to be strictly followed until the next meeting. Instead, the FOMC provided “guidelines” to trading desks, ranges in which the federal funds rate can vary and then provided guidance for how purchase and sale policy should adjust relative to various “money market conditions”. In other words, the NYFRB trading desk had discretion to move interest rates up and down depending on what was going on with the Federal Reserve’s intermediate targets.

It should be clearer now why so many, including within the Federal Reserve, were so concerned! Without a quantitative and “objective” single intermediate target, the trading desk was being given an astounding level of discretion to effectively decide monetary policy on its own. Thus some elements of monetarism appealed to Federal Reserve insiders, because it was believed that providing an intermediate money supply target for the trading desk would constrain its discretion. Of course, this was not satisfying to true U.S. monetarists. This is a point I will return to.

Thus, now the Federal Reserve was using interest rates as an operational target in an attempt to influence the broader money supply as an intermediate target in order to accomplish its longer term goals. Interestingly, Milton Friedman was excited for Arthur Burns to become Federal Reserve chairman in 1970, precisely because he believed that Burns would focus much more on the money supply. Friedman’s interesting initial views of Burns, and the Federal Reserve as a whole in late 1969 is something I’m planning on writing about more in coming months (subscribers will know about my passion for Burns as a much-misunderstood figure in the history of monetary policy). Anyway, Friedman was not wrong about Burns. He did bring the money supply as an intermediate target for the Federal Reserve into much greater prominence. You can imagine however, that the 1970s inflation leads monetarists to downgrade simply “looking” at money supply, or using it as an intermediate target. For the rest of the world, Burns was a hawk. For monetarists, Burns was an inflationist because he was not using the money supply as an operational target. I wrote about this last fall.

This brings us to the Volcker era and the “Volcker shock”. I also wrote about this exact issue last fall so I will not go into a tremendous amount of detail or substantiate what I say here very much. If you want the details and the evidence, read my piece on this topic. For now, it's sufficive to say that what Volcker did was greatly expand the range over which the Federal Funds rate could fluctuate. This both gave the trading desk greater discretion and “hid'' what their interest rate policy was. They did not announce the bands over which the Federal Funds rate was varying. At the same time, they announced what seemed like operational money supply targets.

This was initially very exciting for monetarists because initially it was seen as the Federal Reserve “finally” adopting a full money supply targeting system. They, however, quickly got disillusioned. The Federal Reserve doesn’t implement policy in a way that they thought was necessary to “truly” control the money supply from operational target, through to intermediate target, and from there the economy as a whole. They were right, of course. But the reason the Federal Reserve didn’t do things their way is that it has always been simply impossible. Pretending that they were possible was politically convenient for the Federal Reserve, but was never going to shift reality.

This experiment with “practical monetarism”, the euphemism insiders used to discuss advertising policy as monetarist while operationally doing what is possible, was not successful at monetarism. However, it was successful at accomplishing the Federal Reserve’s goals while avoiding the political pressure that would have come with announced operational interest rate targets. On the other hand, this system was also convoluted and difficult to manage. Pretending to do monetarism is extremely hard and confusing work. The FOMC meeting transcripts at this time are filled with Federal Reserve decision-makers professing their utter confusion at what proposals mean and what changes to their operational policy practically meant. They constantly tinkered with their policy to get it right. Even beyond the operational target, confusing things were happening with the money supply data which made the money supply not useful as even an intermediate target.

Which brings us to Greenspan. During his 19 year reign, the Federal Reserve moved back to interest rate targeting. Not only that, however, they begin holding press conferences every FOMC meeting to announce their new operational interest rate target. In many ways the fundamental institutional structure and public communication apparatus of the Federal Reserve emerged under Alan Greenspan (under intense congressional pressure, especially by congressman Henry Gonzalez). In this world, the trading desk had little to no discretion on the Federal Funds rate. This was interest rate targeting, yes, but more explicit and more straightforward than it had ever been.

However, while the operational target was at the height of clarity, the same cannot be said for intermediate targets. With the failure of broad money supply measures as an intermediate target, the Federal Reserve was back to looking at a raft of indicators. Unwilling to commit to anything, I think the best way to describe the Federal Reserve’s intermediate target at this time is “constructive ambiguity”. This was the infamous Greenspan phrase to refer to him saying vague and incomprehensible things, which could be interpreted in any number of ways. It may be apocryphal, but the anecdote that Greenspan told a congressman that “if you have understood me, I have misspoken” does effectively capture what the Greenspan era was like.

Which brings us to the modern era and today’s FOMC meeting. Nowadays, it is much more clearly stated that, effectively, the Federal Reserve’s intermediate target is “financial conditions”. What’s funny about this is, as you can see, this effectively returns us back to where we started. The operational target is interest rates, and the intermediate target is financial conditions. Monetary policy essentially went on a long, strange trip throughout many different intellectual trends and policy difficulties to end up back where we started. Of course, the process is far better. The Federal Reserve typically, with a few notable recent failures, communicates about what future policy is, and what they are doing with their operational target. The NYFRB trading desk has no discretion over setting the operational target. Process improvements aside, the fundamental policy framework is now the same.

Some readers may object that while on the surface it appears identical to the pre-1964 Martin Fed, actually today’s notion of financial conditions is more precise and sophisticated. Now we have financial conditions indices! In some ways, this is true. We know far more about what financial stresses look like and we have far, far more data. In other ways, this is not true. If you look under the hood of those financial condition indices, they seem just as “atheoretical” and just as much of a “grabbag” as the mixture of indicators the Martin Federal Reserve relied on. Take the National Financial Conditions Index produced by the Chicago Federal Reserve. It looks nice and pretty. In reality, it is 105 different measures that are more or less arbitrarily weighted. These are put into the same indicator without any analysis, or clear indication that many of the “indicators” are quite different. The majority are quantitative, but there are also many qualitative data sources jammed into the index!

So do we have more data today? Clearly! Is it better? I’m not so convinced. In short, theoretical coherence has not yet come for financial conditions, at least not at the Federal Reserve.

The other issue is that it is not clear how seriously the Federal Reserve takes financial conditions as an intermediate target. As Skanda Amarnath & Preston Mui over at Employ America said on Saturday, the recent events with Silicon Valley Bank and the policy response have tightened financial conditions. There is far greater financial uncertainty at this moment, while banks tighten lending standards for a variety of reasons. If you take the intermediate target concept seriously, interest rate increases are less “necessary” to decrease demand in the economy. These factors will already decrease demand! Continuing to hike would suggest they don’t really trust their own professed focus on financial conditions. It’s only tightening financial conditions if it comes from the Eccles Building in Washington DC… otherwise it's just sparkling financial instability.

That means a Federal Reserve decision to increase interest rates today would not simply be a mistake. It would bring up far more fundamental questions about the Federal Reserve’s operating framework. So at this point, I’m very interested in seeing what they will do.

Sign up for Notes on the Crises

Currently: Comprehensive coverage of the Trump-Musk Payments Crisis of 2025